As MiCA brings structure to crypto-asset services, two activities stand out as particularly tricky for VAT: execution of orders and reception & transmission of orders.

On paper, they look almost identical — taking client instructions and ensuring trades happen. But VAT legislation cares less about labels and more about how the service is delivered. Are you acting as a broker/intermediary (negotiation), or just providing technical infrastructure (a taxable service)?

That distinction is what determines whether your fees are exempt or standard-rated.

What MiCA Says

- Execution of Orders (Art. 3(1)(21))

“The conclusion of agreements, on behalf of clients, to purchase or sell one or more crypto-assets … including contracts at the moment of their offer to the public or admission to trading.” - Reception and Transmission of Orders (Art. 3(1)(23))

“The reception from a person of an order to purchase or sell … and the transmission of that order to a third party for execution.”

In practice, these two services are the crypto equivalents of traditional brokerage activities.

The Key VAT Principle: Negotiation vs. Technical Service

EU VAT law (Article 135 of the VAT Directive) and CJEU case law (CSC Financial Services C-235/00; Ludwig C-453/05) draw a sharp line between two categories of service:

- Negotiation (VAT-exempt)

- Actively executes the order on behalf of a client;

- Participates in bringing counterparties together and concluding the transaction;

- Provides more than just technical or infrastructural support;

- Comparable to a traditional stockbroker’s role.

- Technical Services (Taxable)

- Providing automated infrastructure (APIs, matching engines, dashboards);

- CASP is not “in the loop” of the financial flow, only offering the tool;

- Treated as a taxable digital/technical service.

The Maltese VAT Guidelines for DLT Assets mirror this distinction almost word-for-word. They clarify that exemption only applies when the CASP is genuinely carrying out financial intermediation, i.e. acting as a negotiator or broker in the sense recognised by EU case law. Where the CASP simply provides “mere technological services” — such as hosting a trading interface or order-matching engine — the service may be regarded as outside the scope of the financial exemptions and therefore fully taxable.

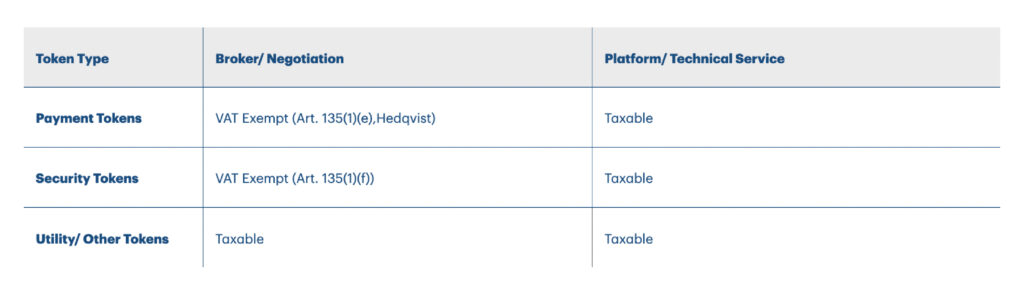

VAT Treatment by Token Type

🔹 Payment Tokens

- Exempt if the CASP executes or transmits orders as a broker (Art. 135(1)(e), backed by Hedqvist C-264/14).

- Taxable if the CASP only provides infrastructure.

🔹 Security Tokens

- Exempt if the CASP actively negotiates or executes trades (Art. 135(1)(f)), consistent with securities brokerage.

- Taxable if the CASP limits its role to technical access.

🔹 Utility or Other Tokens

- Always taxable — these tokens are not financial in nature, so no exemptions apply.

- Execution or transmission fees are subject to VAT (or reverse charge/OSS depending on client location).

This split follows the same principle we highlighted in our earlier articles on exchanges and custody: VAT legislation looks at both the function of the token and the nature of the service. A CASP brokering trades in Bitcoin will fall under a very different VAT regime than one routing orders in a platform utility token — even if the service model looks identical on the surface.

This means the same service could be exempt in B2B but taxable in B2C depending on whether the CASP is a broker or platform provider.

Summary Table – Execution & Reception/Transmission of Orders

Final Thoughts

For CASPs, the difference between being a broker and being a platform provider isn’t just operational — it’s fiscal.

- If you’re actively executing or transmitting orders as an intermediary, you may qualify for VAT exemption (at least for payment and security tokens).

- If you’re only offering infrastructure, you’re providing a taxable service.

The compliance takeaway is clear: classify both your service model and the token type before deciding VAT treatment. Get this wrong, and you risk mischarging VAT on every trade.

📌 Written by Zachary Cachia – FCCA, FIA, CPA

Disclaimer

This article is for general information only and does not constitute tax, legal, or financial advice. Always consult a qualified advisor for tailored guidance.