As crypto service providers move toward regulatory compliance under MiCA, understanding how VAT applies to the custody of digital assets is becoming a priority. One of the most overlooked aspects? The VAT treatment of custody services depends entirely on the type of token being held — not just the nature of the service itself.

It’s also important to note that many wallet providers offer custody or safekeeping services at no charge — particularly in B2C or retail models. In such cases, the service does not qualify as a “supply of services for consideration” under the EU VAT Directive, and is outside the scope of VAT altogether. Where no fee is charged — and there is no indirect compensation (e.g. through bundled fees or monetised access) — no VAT treatment arises.

However, where custody fees are charged, the VAT implications depend on the nature of the crypto-asset being held, and that’s where things get complex.

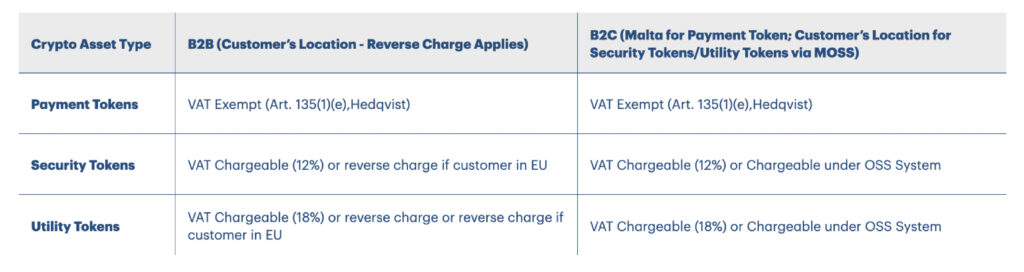

Here’s a breakdown of how this works in practice, using the Maltese and EU VAT frameworks.

Key Principle: Function Over Form

Payment Tokens are crypto-assets primarily used as a medium of exchange, functioning similarly to traditional currency — examples include Bitcoin or USDT, when accepted as a means of payment. The CJEU’s landmark decision in Case C-264/14 (Hedqvist) held that Bitcoin, despite not being legal tender, performs the same economic role as currency and should therefore be treated as such for VAT purposes. On this basis, Article 135(1)(e) of the VAT Directive, which exempts transactions in “currency, banknotes and coins used as legal tender,” applies. This interpretation is also echoed in the Maltese VAT Guidelines, which confirm that wallet and custody services involving payment tokens qualify for VAT exemption, provided the token is used in a payment function. As a result, custody fees charged for holding payment tokens are VAT-exempt, much like traditional banks do not apply VAT on deposit account maintenance.

2. Custody of Security Tokens – VATable at 12% or Reverse Charged

Security Tokens are crypto-assets that mirror traditional financial instruments, such as shares, bonds, or units in collective investment schemes. While Article 135(1)(f) of the VAT Directive exempts transactions in securities, this exemption explicitly excludes services related to safekeeping and administration. This distinction has been confirmed by the CJEU in Case C-235/00 (CSC Financial Services), where the Court held that custody and administrative functions related to financial instruments are not exempt because they do not constitute financial transactions in themselves. Consistent with this, the Maltese VAT Act and accompanying DLT Asset Guidelines classify the custody of security tokens as a taxable service, not benefiting from any exemption. In Malta, custody services involving security tokens are subject to a reduced VAT rate of 12% for local B2C clients. For B2B clients in the EU, the reverse charge mechanism applies, and where the client is a non-Maltese consumer and the service is fully automated, the OSS system may need to be used to apply VAT based on the customer’s location.

3. Custody of Utility Tokens – Fully Taxable at 18%

Utility Tokens are crypto-assets that grant access to a specific product, service, or digital platform rather than functioning as currency or financial instruments. As such, they fall outside the scope of the financial services exemptions under Article 135 of the VAT Directive. According to the Maltese VAT Guidelines for DLT Assets, custody services involving utility tokens are considered standard administrative or technological services, and not financial in nature. These are therefore subject to VAT at the standard rate of 18% in Malta. When such services are provided to EU-based B2B clients, the reverse charge mechanism applies if the customer is VAT-registered. In B2C contexts, where custody is delivered through fully automated systems (e.g. via APIs or self-service platforms), the service may qualify as an electronically supplied service (ESS) — in which case the OSS (One Stop Shop) rules would apply, requiring VAT to be charged based on the consumer’s location.

Summary Table

Final Thoughts

Crypto custody isn’t a one-size-fits-all service when it comes to VAT. If you’re storing tokens, you need to understand what you’re storing — because that drives whether VAT is charged, at what rate, and where.

The key to compliance is to maintain a token-sensitive approach to classification and apply the VAT exemptions (or not) based on the function of the token, not just its label.

📌 Written by Zachary Cachia – FCCA, FIA, CPA

Disclaimer

This article is provided for general informational purposes only and does not constitute legal, tax, or professional advice. While care has been taken to ensure the accuracy of the information herein, the VAT treatment of crypto-asset services is complex and evolving. Businesses should seek tailored advice based on their specific facts and circumstances, and consult with qualified tax professionals or local authorities before making any decisions.