So far in this series, we’ve seen that VAT treatment for crypto services often hinges on token type (payment, security, or utility) and service model. But when it comes to advisory services, the VAT outcome is refreshingly simple: they are always taxable.

Whether you’re advising on Payment token trades, security token trades, or utility tokens, advisory and consultancy services do not fall within the EU’s VAT exemptions for financial transactions.

What MiCA Says

MiCA defines advisory services in Article 3(1)(2) as:

“Offering, giving or agreeing to give personalised recommendations to a client, either at the client’s request or on the initiative of the crypto-asset service provider providing the advice, in respect of one or more transactions relating to crypto-assets, or the use of crypto-asset services.”

This mirrors traditional financial advice — but the VAT outcome is different. Unlike transactions or intermediation in securities or currency, pure advice is never exempt.

Why Advisory Services Are Always Taxable

EU VAT Directive Article 135 exempts only:

- Transactions in currency (Art. 135(1)(e)), and

- Transactions in securities (Art. 135(1)(f)).

But advice about those transactions? Not exempt.

The CJEU has been clear on this point:

- Deutsche Bank (C-44/11): Investment advice and portfolio management are taxable, even when they concern exempt securities.

- GfBk (C-275/11): Consultancy services provided to a fund are taxable unless they form part of collective investment fund management.

This reasoning extends directly to crypto. Advisory services don’t execute a financial transaction — they guide the client. VAT legislation treats this as a general consultancy service, fully within scope.

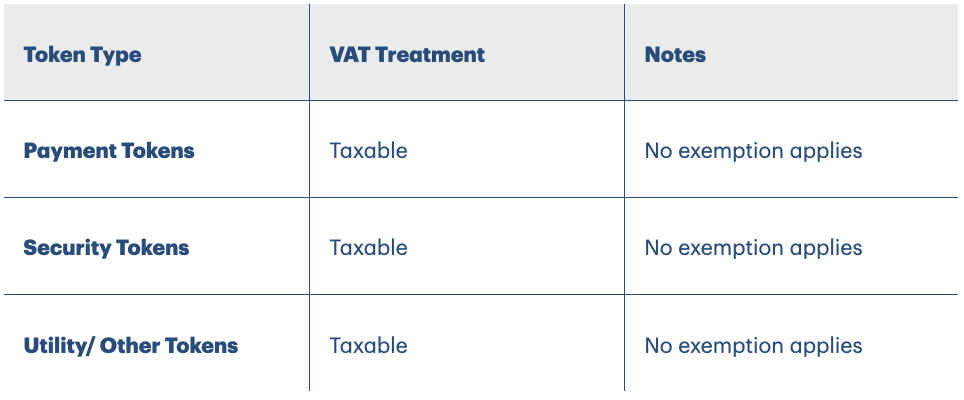

VAT Treatment by Token Type

Here’s the easy part:

- Payment Tokens: Advice on trading Bitcoin or stablecoins → taxable.

- Security Tokens: Advice on tokenised bonds or equities → taxable.

- Utility/Other Tokens: Advice on governance or platform tokens → taxable.

The token classification doesn’t change the outcome. Unlike custody or exchange, where the type of asset matters, advisory is always VATable.

Place of Supply Rules

- B2B clients: Place of supply = customer’s location (reverse charge applies in the EU if VAT-registered).

- B2C clients: Place of supply = where the supplier is established (Malta).

- If advisory is provided in a fully automated format (e.g. via online tools, algorithms), it may qualify as an electronically supplied service (ESS), in which case VAT is due in the customer’s location under the OSS system.

Final Thoughts

Unlike other Crypto services, advisory services offer no ambiguity: they are always taxable. The VAT outcome doesn’t change with token type or transaction structure.

For CASPs, this means advisory revenues must always be included in VAT returns, with careful attention to place of supply and OSS rules for B2C. keep pace with your advisory activities.

⚠️ Disclaimer: This article is for general information only and does not constitute tax, legal, or financial advice. Always consult a qualified advisor for tailored guidance.